tax avoidance vs tax evasion australia

In tax evasion you hide or lie about your income and assets altogether. The main difference between tax evasion and tax avoidance is that evasion is an illegal activity meant to deliberately dodge tax expenses and avoidance is the highly.

Tax Evasion The Budget Cost Prosper Australia

Basically tax avoidance is legal while tax evasion is not.

. To summarise tax avoidance is a legal and legitimate strategy. Tax evasion is an illegal activity that involves lying to the IRS or another taxing authority about the amount you owe. In tax avoidance you structure your affairs to pay the least possible amount of tax due.

The most serious tax fraud. Tax envision is suppression of tax while tax avoidance is hedging of tax. Tax evasion is the use of illegal methods of concealing income or information from the IRS or other tax authority.

However for some time the Australian Government. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different. The test applied in judicial determinations is based on the dominant.

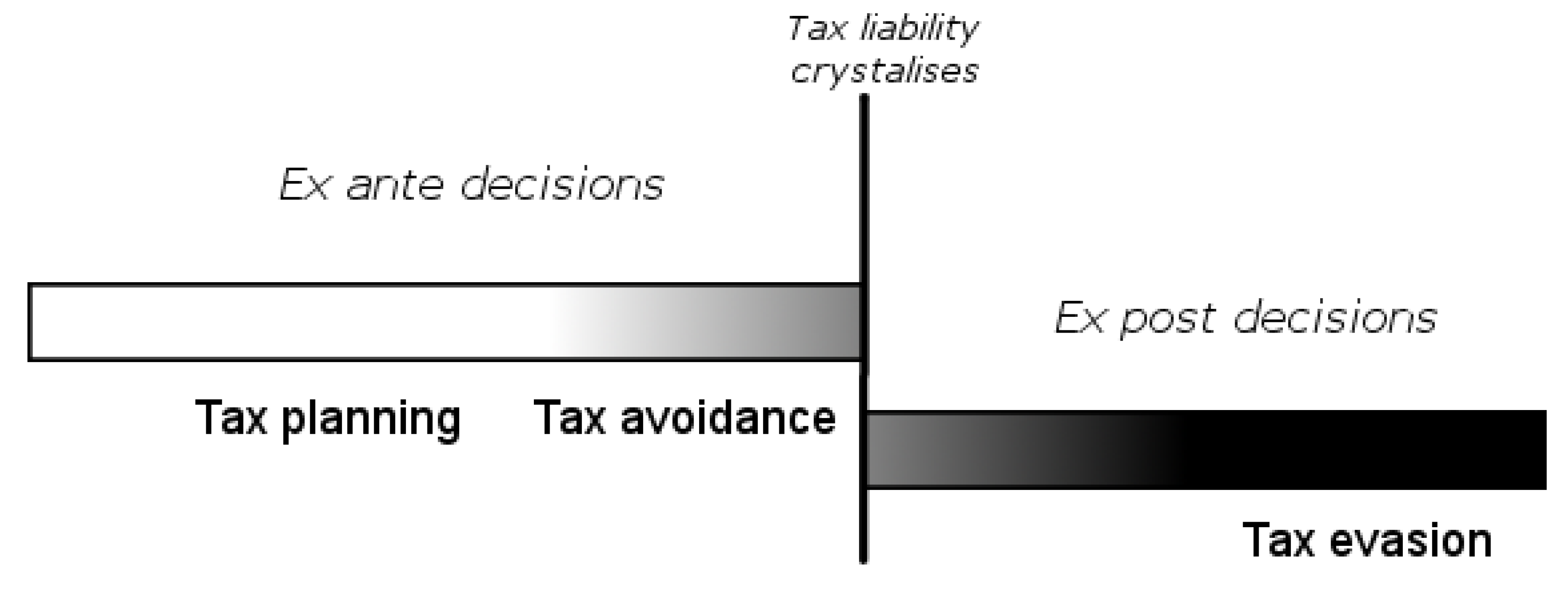

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. The line between tax avoidance and tax evasion can be very thin and at times indistinguishable. The distinction between tax avoidance and tax evasion has been well established in the australian taxation system.

It can involve misrepresenting your income purposefully. Tax evasion includes underreporting income not. The most serious tax fraud.

The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system. Tax avoidance uses lawful methods found in the tax code to cut your total tax liability. The arrangement might allow you to not declare certain income.

Tax avoidance vs tax evasion. Tax avoidance is when you create artificial or contrived arrangements to obtain a tax benefit. While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law.

The main objective of a tax advisor is to assist hisher clients avoid taxes as much as possible through within the confines of the law in. At its core it requires deliberately structuring your assets in such a way that you pay as. Tax avoidance is to decrease the tax.

Tax avoidance is just avoiding while tax evasion is to break all rules of the tax. Excerpt from Essay. The distinction between tax avoidance and tax evasion has been well established in the australian taxation system.

Tax evasion can result in fines penalties andor prison time. Tax evasion can lead to a federal charge fines or jail time. To start with tax avoidance is legal while tax evasion is illegal.

Tax Evasion V Tax Avoidance Is There A Difference Pace International Law Review

Tax Avoidance V Tax Evasion Lawpath

Question On Tax Avoidance Vs Tax Planning Vs Tax Evasion Youtube

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Solved Company 3 1 2 3 3 1 2 3 Q5 Explain The Key Chegg Com

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Multinational Tax Avoidance News Research And Analysis The Conversation Page 1

Requalification Of Tax Avoidance Into Tax Evasion

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Pdf Tax Evasion Tax Avoidance And Tax Planning In Australia The Participation In Mass Marketed Tax Avoidance Schemes In The Pilbara Region Of Western Australia In The 1990s

The Fiscal And Distributional Consequences Of Global Tax Avoidance And Tax Evasion Eutax

Tax Avoidance Is Legal Tax Evasion Is Criminal Wolters Kluwer

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Evasion The Budget Cost Prosper Australia

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance And Tax Evasion In 14 Itc Countries Ppt Download

Pdf Tax Fraud When Is Tax Avoidance A Criminal Offence

Differences Between Tax Evasion Tax Avoidance And Tax Planning